Financial risk tolerance relates to investing and is important for you to understand if you want to grow your money efficiently. It is even more important for your Financial Advisor to understand your risk tolerance to assure that their investment recommendations, collectively, do not put you in a precarious position.

However, like with many finance-related concepts that aren’t taught by most parents or schools, you like most people might not be aware of risk tolerance as a factor in determining your financial path and portfolio.

Our goal with this blog post is to provide insight into what makes up financial risk tolerance, and also to provide ways for you to determine how much money you are willing to risk to achieve financial gain – i.e. risk versus reward.

What is Financial Risk Tolerance?

Risk tolerance is the degree to which someone is willing and able to withstand negative returns on an investment against the opportunity to reap positive gains on the investment. Simply ask yourself: How much are you willing to stomach substantial changes in the value of your investments?

You probably understand by now that there are no sure investments. If there were, everyone would be rich and living on their own islands drinking out of funny-shaped glasses with straws in them. Portfolio investment components such as 401(k) accounts, over time, will make or lose money. There are many factors that affect how your investment will pan out, as financial markets are more volatile at some times than at other times.

There are also personal factors that can affect your ability and willingness to risk your hard-earned money. These factors include your future earning capacity; whether or not you own assets such as a home, a pension, or an inheritance; collection of Social Security; your age and time until retirement; and your investing goals, such as college savings, retirement savings, wealth building, or paying off debt.

Types of Risk Tolerance

Now let’s look at some different types of risk tolerance and some examples of real situations that can help you further understand what your tolerance might be today.

Conservative risk tolerance, or low risk tolerance, means that an investor would not want to stomach large swings (gains or losses) in their portfolio value. They would want to be more conservative and stay away from risky investments like some stocks and prefer investments such as bonds. Someone with low risk tolerance who is more risk-averse and who gets placed into an aggressive portfolio might panic if they start to see losses and sell securities at the wrong time, rather than waiting for an upswing. Think of low risk tolerance as safer, but with this comes a lesser chance to make significant financial gains, or possibly not even keep up with inflation.

Aggressive risk tolerance is the other end of the spectrum. Investors who lean aggressive are willing – and able (or, at least believe they are) – to endure periods of loss for the opportunity to make substantial profits on investments if they believe their plan is sound. Aggressive investors typically have great understanding of securities, investment options, brokerage accounts, and finances as a whole. They often pursue risky ventures such as small company stocks and other vehicles that are the furthest things from sure bets. Think of aggressive risk tolerance as very risky and less safe, but with this comes a higher chance to make greater financial gains.

Moderate risk tolerance means that an investor is willing to pursue a balanced approach of safe and risky investments. Moderate investors are willing to accept some losses at the chance for gains, but typically stay away from very risky investments. Investing in mutual funds, for example, may be strategy for the moderate investor. Think of moderate risk tolerance as somewhat aggressive but focused on building and growing the nest egg.

Risk Scenarios

Let’s look at an example of how age and investment goals might impact a person’s risk tolerance and financial approach.

Mary is 63 years old. She has a 401k that is substantially funded, and plans to work for six or seven more years and then collect Social Security. She plans to spend time with her grandchildren and travel to see Europe. She also wants to leave some money for her daughter and grandchildren.

John is 44 years old. He has a job that pays well and a 401k that he’s been adding money into, but he only has moderate funds in this account. He also has two sons in high school, and he plans to help pay for their college tuitions while also saving for retirement.

Mary may opt for less risk tolerance in her financial plan. She wants the money she’s saved, earned, and invested to grow and not have tremendous market exposure, in case there’s a downturn. And since she’s older than John, she has much less earning potential. She also plans on collecting Social Security much sooner, which adds to income and is less risky than making an aggressive investment.

John may opt for moderate to aggressive risk tolerance. He has substantial earning potential with his job, and at 44 he would have time to recover if there’s a market downturn. However, he also needs to balance household expenses with anticipate college tuition, all while trying to save for retirement.

These are very rudimentary examples, but you can see how different factors may impact what time of investments you might make and how risk you might want to be. It’s important to ask yourself: What stage of life are you in today? What are your financial goals?

Then, it’s important to find out how aggressive or risk-averse you are by nature.

What is My Financial Risk Tolerance Score?

Before making any type of investments and determine what financial path to go down, it is strongly advised that you determine your personal financial risk tolerance score. This traditionally has been done by answering a series of questions that tries to pinpoint how risky you might be as a person.

These answers will give you a risk tolerance score. This score puts you into one of the three risk tolerance categories, Conservative, Moderate, or Aggressive. This classification, combined with your current savings, assets, and goals, will help you and your Financial Advisor determine what investments are right for you and your family.

But what if your score places you at the very bottom or very top of the Moderate range? A “moderate” investment portfolio might cause you disappointment. If you’re at the very bottom, you might be uneasy about the risk your portfolio was exposed to; and if you’re at the very top, you might feel that your portfolio was not getting enough risk exposure. This is why it’s important to understand what your risk score means – and then discuss it with your Financial Advisor.

There are various surveys and calculators (see below) that can help you think about your risk tolerance. They may ask you questions like, “You have just reached the $25,000 mark on Who Wants to be a Millionaire? You can either take the $25,000, or risk it against one of the following scenarios. You have a 55% chance of winning $50,000, a 25% chance of winning $80,000, or a 7% chance of winning $100,000. Which option would you choose?”

There are many similar questions that you might be asked. In our experience, these are a bit confusing and mentally draining for most people – especially if there are 25 or 30 questions. We opt instead to offer, through one of our trusted third parties, Riskalyze, a quick, free financial risk analysis that can help you answer the question: How risky are you?

Here’s what we like most about Riskalyze, as opposed to some other similar types of tolerance determinants.

Instead of being characterized into one of three categories, Riskalyze takes your information and assigns your risk tolerance by a number between 1 and 100, or 99 categories. Three categories (Conservative, Moderate, and Aggressive) might work well for sweat pants (small, medium, and large), but you would not order your wedding dress or a business suit this way. More specific is better in this scenario.

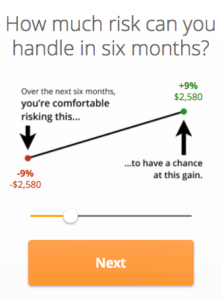

Also, Riskalyze determines within 95% probability the floor and ceiling of your portfolio over a 6-month period, helping you visualize in real numbers. The platform also takes the information you supply and shows you within 95% probability the loss and/or gain in your particular portfolio in dollars as opposed to percentages.

Calculating Your Financial Risk Tolerance

Here is an overview of how you can use Riskalyze to calculate your financial risk tolerance.

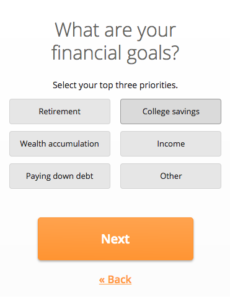

One of the first screens asks you about your financial goals – an important determining factor in any investment and financial plan. See below.

Next, you are asked a few simple questions with real numbers to help you think about your risk approach. The question is based around how much risk you would be able to stomach within six months for the chance at financial gains.

After a few more modifying questions aimed at helping you hone in on your specific risk tolerance in the near-term. At the end, you are given a risk score from 1-100.

What Does My Risk Score Mean?

From a 40,000-foot view, you could generalize that any score 35 and below would represent a Capital Preservation Portfolio (maintaining what you already have). Scores of 20 to 45 would represent a Conservative Portfolio, 35-70 a moderate Growth and Income Portfolio, 50-90 a moderate to aggressive Growth Portfolio, and 75-99 an Aggressive Portfolio.

If you are concerned about aligning your portfolio with your true personal risk tolerance, our advice would be to talk with your Financial Advisor about doing so. (Obviously, we can help you with this as well!)

In our experience, what people think their risk tolerance is does not match their risk score. This is why it’s so important to go through the risk calculator and then speak with a professional that can give you options and explain different paths.

So, what is your risk score? NOTE: Once you receive your score, contact us to find out what your current retirement and/or brokerage account risk number is and see if it is aligned with your risk tolerance number.

Additional Resources

Investopedia is an excellent resource for all things financial. Their risk tolerance video provides a more detailed overview of risk tolerance examples and more specific examples for savvy investors.

We also found a few other risk tolerance calculators that ask different questions to help you think about your riskiness. One is from CalcXML and the other is from financial giant Merrill Lynch (though this one is advanced and very technical).

Next Steps for You

After determining your risk score, you might have questions about next steps for your investments. Your score might even seem off. Please feel free to contact us to discuss your results and see what options might be best for you in your specific situation and stage of life.

No Comments